Canon G1X Mark III review

-

-

Written by Gordon Laing

Quality

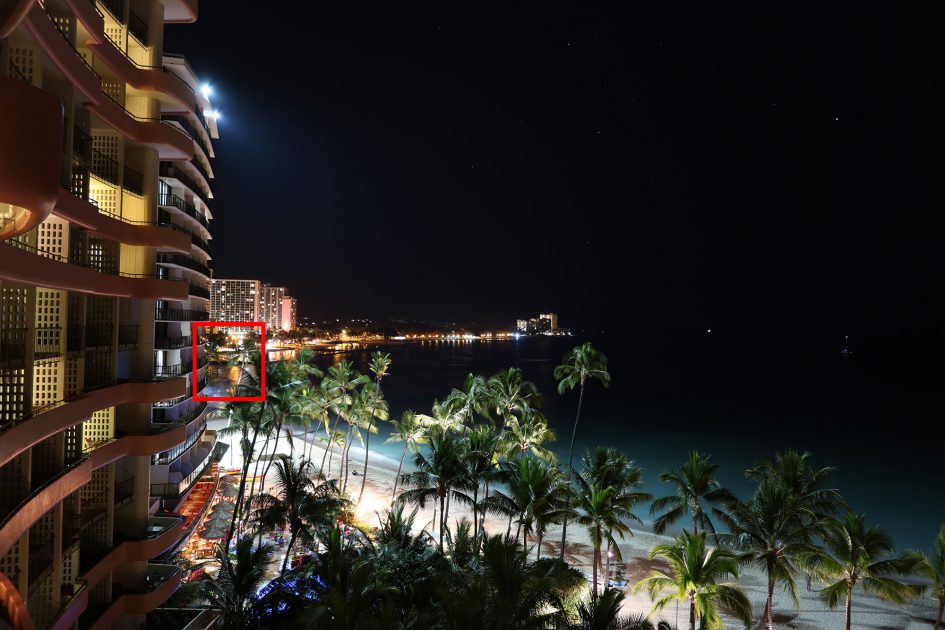

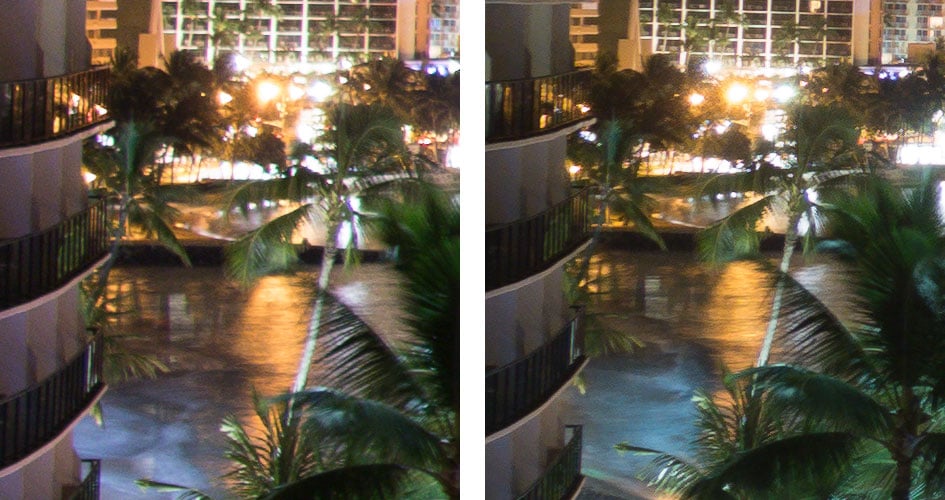

Canon G1X Mark III vs Sony RX100 Mark V JPEG noise

Above left: Canon G1X III at 100 ISO. Above right: Sony RX100 V at 125 ISO. Both 100% crops from JPEGs

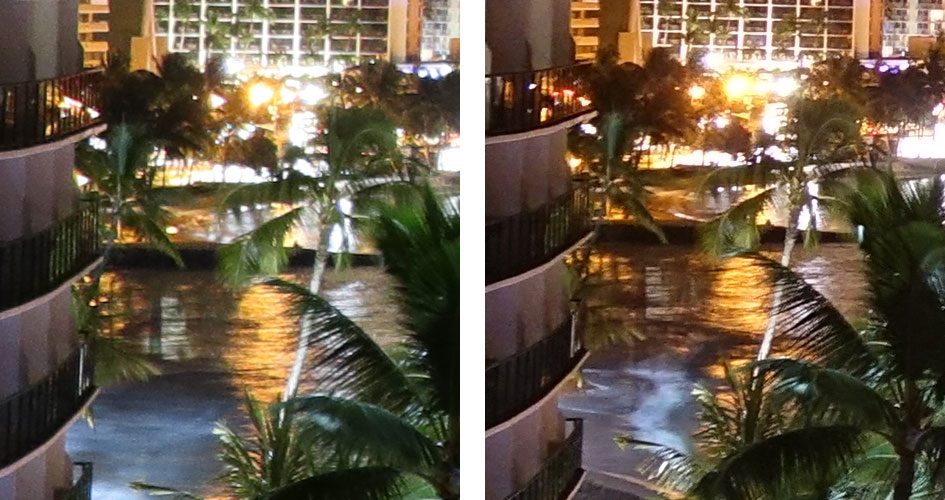

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 200 ISO

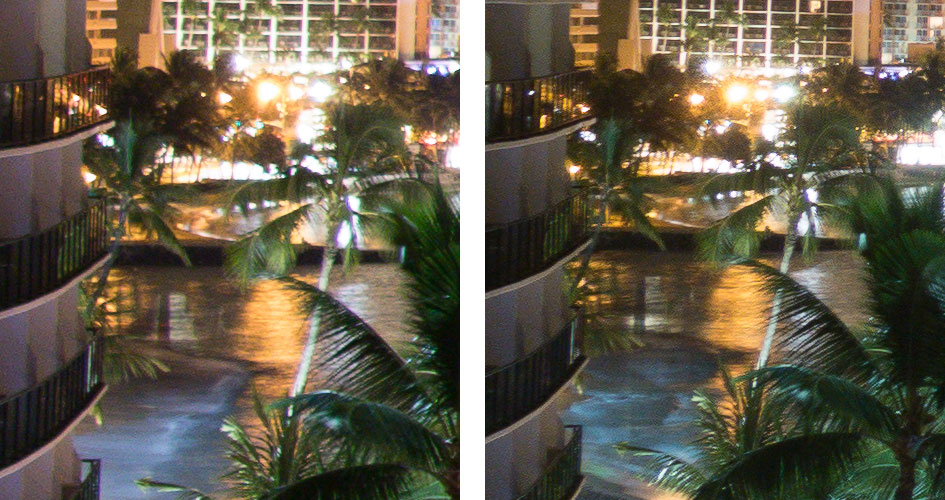

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 400 ISO

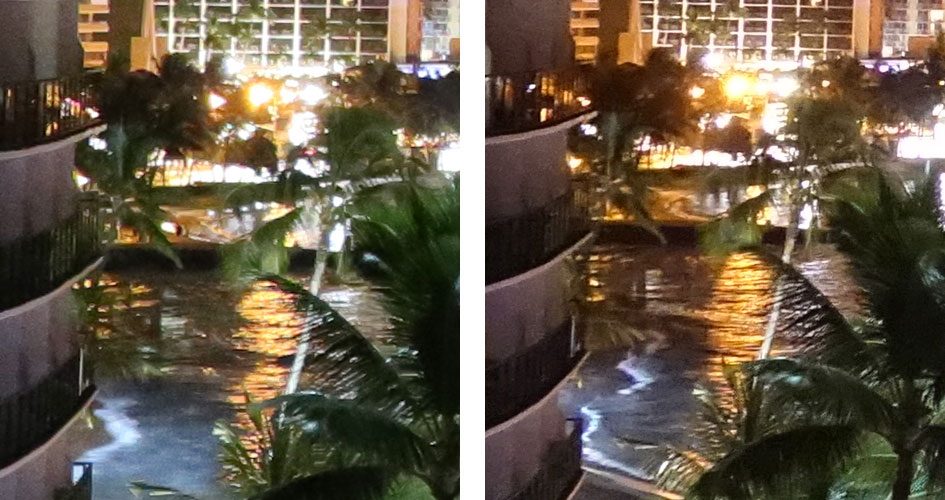

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 800 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 1600 ISO

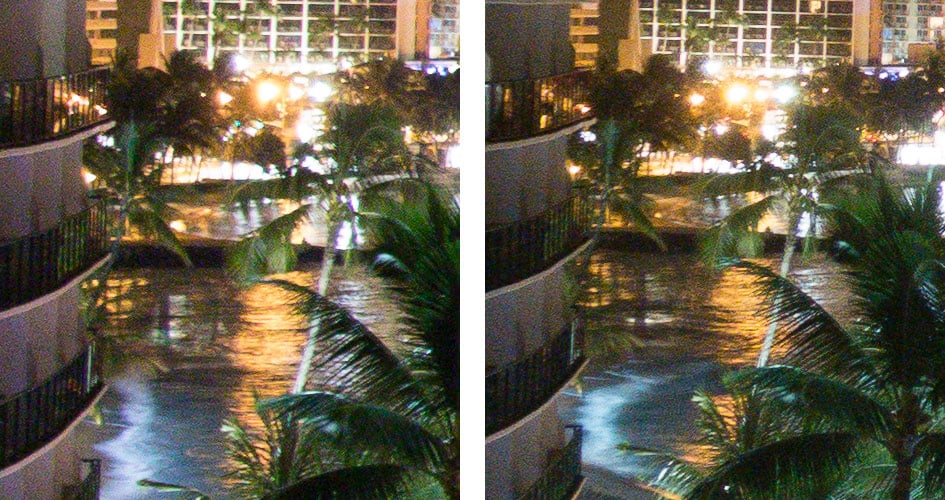

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 3200 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 6400 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from JPEGs at 12800 ISO

Above left: Canon G1X III. 100% crop from JPEG at 25600 ISO

Canon G1X Mark III vs Sony RX100 Mark V RAW noise (ACR 50 / 0.5 / 36 / 10)

Above left: Canon G1X III at 100 ISO. Above right: Sony RX100 V at 125 ISO. Both 100% crops from RAWs

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 200 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 400 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 800 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 1600 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 3200 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 6400 ISO

Above left: Canon G1X III. Above right: Sony RX100 V. Both 100% crops from RAWs at 12800 ISO

Above left: Canon G1X III. 100% crop from RAW at 25600 ISO

Check prices on the Canon G1 X Mark III at Amazon, B&H, Adorama, or Wex. Alternatively get yourself a copy of my In Camera book or treat me to a coffee! Thanks!