Sony Cyber-shot HX90V review

-

-

Written by Ken McMahon

In depth

The Sony Cyber-shot HX90V is the World’s smallest compact camera with a 30x optical zoom. Announced in April 2015, it’s the successor to the HX60 and HX50 models, sharing a similar optical zoom range, but packed into a smaller body.

The HX90V delivers an equivalent range of 24-720mm, taking you all the way from respectable wide angle to super-telephoto, although the earlier G-series optics have been upgraded to a new design by Zeiss. Along with claiming superior quality, the new optics occupy 30% less volume, allowing the smaller body to be achieved.

Like its big rival, Panasonic’s Lumix TZ70 / ZS50, the new HX90V features a built-in electronic viewfinder which is popped-out the top of the body for use like the RX100 III and IV. Unlike the TZ70 / ZS50 though, the HX90V also sports an articulated screen which can tilt up to face forward for selfies, along with built-in GPS hardware, a useful capability Panasonic removed from the latest model. Like previous generations, Sony offers two versions of its pocket super-zoom, the HX90V with GPS and the HX90 without. For my review I’ve tested the HX90V alongside the Panasonic TZ70 / ZS50 and the latest compact super-zoom from Nikon, the COOLPIX S9900. Find out which compact super-zoom will be best for you!

Sony HX90V design and controls

The Cyber-shot HX90V’s styling represents a departure from its predecessors, instead taking design cues from the higher-end RX100 III and IV. I’ve pictured it below (left), alongside the older HX60 (right) and it’s clear how the newer HX90V is indeed comfortably smaller.

Measuring 102x58x35mm and weighing 245g with battery, the HX90V is noticeably shorter and narrower than its arch rival, the Lumix TZ70 / ZS50 which measures 111x65x34mm and weighs 243g. Is this a difference you should take account of? Well, it depends how important portability is to you. There’s enough of a difference in size (though not weight) to make the HX90V feel smaller and more pocketable and indeed I was happy with it in my jeans pocket. The TZ70 / ZS50 is just a bit to big to be able to do that comfortably.

Despite its small size the HX90V fits comfortably in your hand and there’s a grip on the front panel that while not as substantial as the one on the Lumix TZ70 / ZS50, does the job just as well. Oddly, though it’s almost the exact same weight as the Lumix TZ70 / ZS50, the smaller HX90V feels a little heavier; denser would be a better word, but however you put it it certainly has the feel of quality engineering.

If I were to make one criticism of the design it would be the tiny flat thumb rest on the rear. A tiny bit of contour on it – as there is on the Lumix TZ70 / ZS50 and the COOLPIX S9900 – would have made for a much more secure grip.

That aside, the HX90V looks and feels beautiful. The top panel is a flat surface with two flush panels visible by their outline. The one in the middle is the pop-up flash, which extends on a spring arm by a small switch next to it. On the right corner of the body is another small switch labelled finder which pops-up the built in electronic viewfinder. The viewfinder is new to the HX90V and undoubtedly a response to Panasonic’s decision to introduce one on last year’s TZ60 / ZS40.

The built-in viewfinder of the latest Lumix TZ70 / ZS50 makes it the closest rival to the HX90V, but Panasonic and Sony have taken different approaches to implementing them. On the Panasonic TZ70 / ZS50, the viewfinder is perched in the upper left corner, above the screen, while on the Sony HX90V it’s housed within the body, popping-out of the top surface when required. There’s pros and cons to both approaches. The Lumix viewfinder is always ready for action as soon as you raise it to your eye, whereas the Sony viewfinder needs to be popped-up and pulled out towards you for operation, like the RX100 III and IV, a process which takes a couple of seconds. The flipside is the Lumix viewfinder forces the body to be taller than the Sony and the screen to be wider than the native shape of its images, while the HX90V can implement a 4:3 shaped screen to match its image shape and squeeze it all into a shorter body. Like the Lumix TZ70 / ZS50, the HX90V employs an eye sensor to toggle between the viewfinder and screen. In a nice update over the RX100 III you can also configure the HX90V so that it doesn’t power-down automatically when the viewfinder is pushed back into the body.

The HX90V viewfinder itself is a 0.2in OLED panel with a 638k dot resolution. If you’re used to a recent DSLR or a mirrorless EVF the HX90V’s viewfinder is going to seem tiny by comparison, but small though it is, it’s incredibly useful and not just as a fall-back when the sun is shining and it’s difficult to see the LCD screen. The EVF makes it much easier to hold the camera steady and compose shots at the longer end of the zoom range.

There’s a tiny bit of coarseness which is visible and the image isn’t as smooth and clearly defined as on the Lumix TZ70 / ZS50’s EVF which employs a higher resolution 1166k dot LCD viewfinder. The panel is the same 0.2in size, but the Lumix viewfinder’s 35mm equivalent magnification is 0.48x, compared with 0.5x for the HX90V. It’s a small difference written-down, but in practice I found the HX90V’s viewfinder image was just that little bit larger.

Viewfinder information is displayed along the top and bottom edges; the important stuff – exposure mode, battery life, image and video quality, and exposure settings is included, but all the other information that’s displayed down the sides on the LCD monitor is omitted as there just isn’t room for it.

Even with limited amount of info in the viewfinder there’s not a lot of room for text overlays, but I think Sony has gone too far with the tiny text used for the EVF display, you really have to concentrate to make it out. Panasonic strikes a much better balance between intrusiveness and legibility with the bigger viewfinder graphics in the (slightly smaller) TZ70 / ZS50 viewfinder. With two pop-up panels on the HX90V’s top plate, there’s no longer room for Sony accessory hotshoe featured on earlier models, a shame, but in my view a trade well worth making.

Of course you’re not limited to the viewfinder and the HX90V has a 3 inch LCD screen with a 921k dot resolution. This is the same size as on the earlier HX50V and HX60V but now the screen is hinged at the top and can be folded into a forward-facing position for selfies. When you do this a 3-second self timer is automatically set and a nice big countdown graphic is displayed.

The screen on the earlier models suffered from poor visibility outdoors and it’s disappointing to see that the HX90V isn’t improved much, if at all. Both the Lumix TZ70 / ZS50 and the COOLPIX S9900 had brighter screens which were much easier to see when shooting outdoors. Now that it has an EVF this is less of an issue, but it’s nonetheless something Sony seriously needs to address. I found it necessary to ramp the brightness up two notches from the default setting where it stayed for the entirety of the review period.

The HX90V uses the same NP-BX1 battery as its predecessor which provides enough power for a generous 390 shots. It does better than the competition, with both the Lumix TZ70 / ZS50 and the COOLPIX S9900 managing 300 shots. All three models charge the battery in the camera using a USB connection powered either by an AC adaptor or another suitable source such as a laptop or car adapter. In addition to the USB / charging port, there’s a micro HDMI port on the base of the camera, other than their location you’ll find the exact same ports on the Lumix TZ70 / ZS50 and the Nikon COOLPIX S9900.

Sony HX90V lens and stabilisation

At first glance, the HX90V’s 24-720mm zoom looks to be the same lens used in the previous two generations of this models – the HX60V and before it the HX50V. On closer inspection, though, both the focal range and maximum aperture are slightly different. The earlier models had a 4.3-129mm f3.5-6.3 lens, where the HX90V is fitted with a 4.1-123mm f3.5-6.4 lens. And a glance at the front of the lens reveals this is not in fact the G series lens of the earlier models, but an upgraded Zeiss Vario Sonnar T* design.

Though 30x lenses aren’t new, you won’t find a longer range in a model this size. The TZ70 / ZS30 has the same zoom range and though its aperture is slightly wider at the wide angle focal length – f3.3 compared to f3.5 on the HX90V, there’s little practical difference.

Sony HX90V coverage, wide and tele

Above: At 4.1mm (24mm equivalent) and 123mm (720mm equivalent)

The images above show the field of view you can expect to capture with the HX90V at the extremes of its zoom range. The Nikon COOLPIX S9900 also has a 30x zoom, but with a slightly longer 750mm telephoto provided at the expense of a slightly narrower 25mm wide angle. And Canon’s SX710 HS also sports a 30x zoom with a 25-750mm equivalent range. On a compact super-zoom, the zoom range is obviously a key feature but, to be honest, these minor differences are not really worth wringing your hands over.

Like the Lumix TZ70 / ZS50, the HX90V’s lens is equipped with 5-axis stabilisation. As on earlier models the stabilisation can’t be turned of and for my test was left on the default Intelligent Active setting which automatically irons out wobbles caused by walking when you’re shooting movies.

There are few situations where stabilisation is more necessary than when shooting at long focal lengths with a small camera. The HX90V’s stabilisation is not only useful for eliminating camera shake, but is a great help when it comes to composing shots, keeping things nice and steady and enabling you to easily frame up your shot.

To test the HX90V’s stabilisation I zoomed it all the way in to 720mm and took a series of shots in Shutter priority mode at progressively slower shutter speeds with the stabilisation set to the default Intelligent Active mode. As you can see from the image below, you can shoot handheld confidently with the HX90V at speed as slow as 1/25 of a second, I was also able get sharp images on occasions down to 1/15. I was able to get sharp result consistently at 1/25, though, no doubt aided by using the viewfinder – with the HX90V pressed to your cheek you provide a more stable platform. Regardless of that, five stops of image stabilisation is very impressive by any standards.

Above: Sony HX90V, 1/25, 100 ISO, SteadyShot Intelligent Active

Sony HX90V movie modes

The HX90V can shoot HD video at 1080/60p or 1080/50p, this isn’t region-dependent, instead you can choose between PAL or NTSC frame rates from the settings menu.

New to the HX90V is the chance to record in the XAVC S format at a higher bit rate of 50Mbit/s, though to take advantage of XAVC-S modes you’ll need an SDXC card. The new model also enjoys the additional benefits of filming with the built-in electronic viewfinder, or the screen which can flip around to face the subject, making it ideal for composing pieces to camera.

Drilling-down into the specifications, in NTSC modes the HX90V offers Full HD 1080 video at 60p (28Mbit/s), 60i (24 or 17Mbit/s) or 24p (24 or 17Mbit/s), all encoded using AVCHD at the stated bit rates. If you switch the encoding to MP4 you can film at 1080 / 60p at 28Mbit/s, 1080/30p at 16Mbit/s or 720/30p at 6Mbit/s.

Choose the new XAVC S encoding and you can film in 1080 at 60p, 30p or 24p, all at the high rate of 50Mbit/s. In PAL mode, the 60p and 60i frame rates for any of the movie modes are swapped for 50p and 50i, while the 24p is swapped for 25p.

Download the original file (Registered members of Vimeo only)

This clip, like the others below was shot in the HX90V’s 1080 / 50p 28 Mbit/s mode. The quality is very good at this frame rate and compression setting, but the most impressive thing is the stabilisation which irons out wobbles during the pan and does a great job of keeping things reasonably steady when zoomed all the way in.

Download the original file (Registered members of Vimeo only)

For this second clip the camera was mounted on a tripod. You can’t turn the HX90V’s stabilisation off and neither do you have a choice over the focusing – Unless you switch to manual focus it’s automatically set to continuous. So it’s a good job the HX90V’s AF-C autofocus does a such a good job, keeping everything in focus even during the long zoom. Speaking of which, you can’t hear the zoom motor on this clip because of the wind noise, but you could on the previous one.

Download the original file (Registered members of Vimeo only)

The HX90V does a good job with this low light clip which doesn’t look too noisy. The exposure is well handled, but the AF does go for a little wander a couple of times during the pan, though it quickly corrects.

Download the original file (Registered members of Vimeo only)

For this final clip I tested the HX90V’s continuous AF performance by zooming the lens in slightly and panning from the coffee cup on the table up to the bar and back again. The continuous AF does very well here and you hardly notice it switching the focus from the foreground coffee cup to the bar and back

Sony HX90V shooting experience

The HX90V employs contrast-based autofocusing with three modes for stills: AF-S (Single), DMF (Direct Manual Focus) and MF (Manual Focus). AF-C mode is now only available for movie shooting and the option is greyed out when the mode dial is in any other than the movie position.

DMF lets you autofocus with a half-press of the shutter release, after which you can fine tune manually by turning the lens barrel ring, meanwhile MF is fully manual focus.

The Focus Area menu offers four options: Wide automatically chooses from nine main areas, Center fixes the AF area to the middle of the frame, and Flexible Spot lets you choose one of three AF frame sizes and move them to almost anywhere on the screen apart from a border around the edges.

New is Expand Flexible spot which uses the focus points around the flexible spot as a second priority area, so you don’t need to worry if your subject is moving around a little. In practice I’m not sure this offers any real advantages over simply setting a larger area in Flexible Spot mode though. Manual focus is greatly improved by the addition of focus peaking, though, which in addition to the MF assist magnification feature makes manual focus on the HX90V a breeze.

In AF-S mode the HX90V is reasonably quick to respond and its low light performance seems greatly improved over earlier Sony compacts which all too often in low light would display the single large rectangle indicating that focus couldn’t be achieved using the individual AF points. Indoors in low light and when zoomed in it rarely failed and usually responded with a heartening beep within a short fraction of a second. In these kinds of conditions it consistently outperformed the Lumix TZ70 / ZS50 which also lagged behind the COOLPIX S9900.

In Continuous Shooting Hi mode the HX90V can shoot a one-second burst of images at 10fps with the focus and exposure locked on the first frame. I timed a 10-frame burst at 0.89s, so it’s actually a tiny bit quicker.

Above: 1/500, f6.4, 80 ISO, 123mm (720mm equivalent) Continuous Hi drive mode

This is the same continuous shooting performance that you’ll find on the earlier HX60V and the HX50V, so it’s a little disappointing to see it unimproved. While 10fps is better than respectable on a compact the short burst time really hampers it – if you get the timing wrong, the action can easily happen after the first second, while the HX90V is busy writing frames to the card. And if your subject is moving towards or away from you, the final frames of the sequence may not be in focus.

That said, continuous shooting is a good way to improve your chances of getting one or two good frames from a fast moving subject over using the single shooting drive mode. The shot above is from a sequence of ten frames shot in Continuous Hi mode, some of which were poorly framed and others out of focus, so while it’s not much good as a sequence, there are a few shots that stand up on their own and are probalby better than what I would have got shooting single frames.

While its 10fps speed offers an even shorter burst, the Lumix TZ70 / ZS50 is packed with slower full resolution continuous shooting modes as well as some very fast reduced resolution modes. So that would be a better choice if you want to shoot action, or the Nikon COOLPIX S9900 which is similarly equipped, though it’s worth noting that none of these models provide fast continuous shooting coupled with continuous AF which effectively rules them out for most sports photography.

The HX90V features a built-in Wifi receiver with NFC to aid negotiation with compatible devices. Via the Wifi connection you can transfer photos and video to your computer, connect to hotspots, and share photos to social networking sites. There’s also the option, introduced on the HX60V, to download and install apps to extend the camera’s functionality. You can also control the camera remotely using either an iOS or Android smartphone.

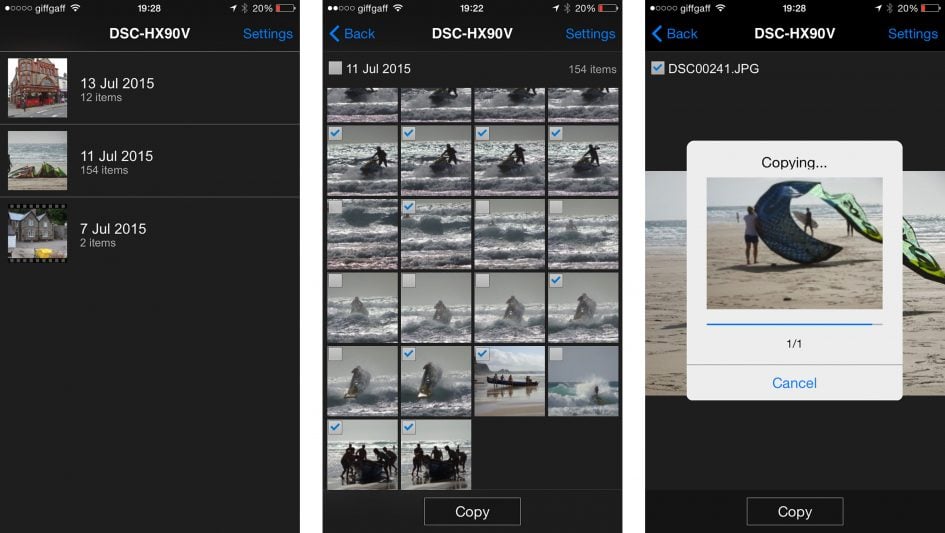

For my tests I used my iPhone 6, onto which I’d previously installed Sony’s free PlayMemories app. Like other recent Sony cameras with Wifi, a dedicated wireless section in the menus starts with an option to Send to Smartphone. Choosing this then gives you the choice of either selecting the desired image on the camera, or browsing the camera’s memory using your handset.

Selecting either configures the HX90V III as a Wifi access point which your phone or tablet needs to connect to. If you have a handset with NFC, the next step is very simple as you only need to tap and hold the camera against it for a moment for it to automatically fire-up the PlayMemories app and sort out the network name and password all by itself. If you don’t have NFC you’ll need to connect to the HX90V’s Wifi network manually and enter the password that’s displayed on the camera’s screen.

A menu in the PlayMemories app lets you choose whether the image is sent in its original 18 Megapixel format or resized down to either 2 Megapixels or 640×480 pixel VGA size. Full sized 18 Megapixel JPEGs typically took around five seconds to copy over.

The second option in the Wifi menu lets you send images to a computer. To do this you’ll need to download the free Wireless Auto Import utility onto your Mac or PC, then briefly connect the camera so that it can be configured with your computer’s details. After this you can disconnect the cable and wirelessly send selected images from the camera to the computer, although both will need to be connected to the same wireless access point. Sadly there’s no direct peer-to-peer option, and while both devices could be connected to the same Wifi hotspot on a phone, you can’t use it as a bridge or router. This limits the wireless transfer to situations where you’re connected to a home or office network, although to be fair this is no different from most other manufacturer’s camera to computer Wifi services.

For the HX90V Sony has adopted an app-based remote control solution, allowing it to upgrade the capabilities. Sony embeds the Smart Remote Control app into the HX90V to get you started in the World of apps, no doubt in an attempt to get you comfortable with the idea and possibly purchase some more in the future. Indeed as further encouragement there may even be an update available straightaway for the Smart Remote Control app; my HX90V was running an old version which didn’t support manual control over exposures beyond compensation, so I connected the camera to the internet and updated the app to the latest version.

Updating an embedded app is the same as installing a new one from scratch. You’ll first need to create an account on the PlayMemories site at playmemoriescameraapps.com. Once you have an account set up there are two ways to browse and download apps. You either can do it using a free download tool running on your computer with the camera connected over USB, or you can do it direct from the camera itself.

I decided to opt for the first method, a process that was, at least for me, less than straightforward. First the app downloader wouldn’t work with Chrome so I had to switch to Safari. Then the browser wouldn’t recognise the HX90V connected to my MacBook Pro via USB until I switched the USB connection to MTP from the settings menu.

If you’re going for the direct approach from the camera, you’ll first need to connect it to the Internet via an access point. Manually entering SSIDs and passwords using a non-touchscreen can be laborious to say the least, but once entered the camera can remember them and connect with a click at a later date.

Once the camera is connected to the Internet you can use the dedicated Apps menu to login to your PlayMemories account and browse and download available apps or update existing ones; again any which aren’t free require you to have previously credited your account using your computer or phone. Once an app is downloaded and installed, it’s added to the list in the Apps menu on the camera. Some apps require access to the Internet, say to upload images, and again the camera will connect via any previously configured access points. Others extend the functionality of the camera and have their own menus.

If you select the Smart Remote Control from the App menu on the HX90V, it’ll again set the camera up as an access point for the PlayMemories app on your phone to connect to. Alternatively if you have a phone with NFC, you can just start PlayMemories and hold it against the camera for Smart Remote to automatically startup.

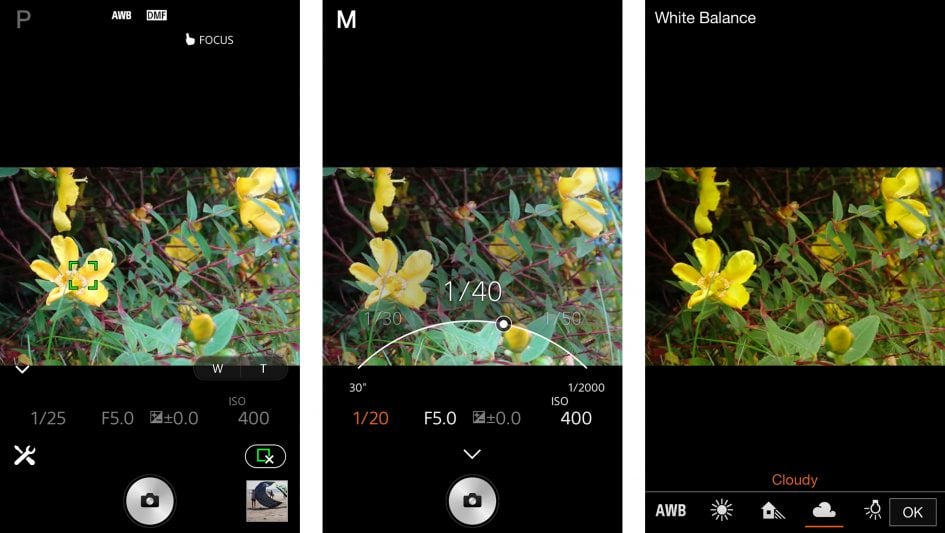

If you’re running the older versions of the phone and camera apps, you’ll be limited to very basic controls which offer little more than exposure compensation. If both the camera and phone apps are updated to the latest versions though, you’ll be offered full control over exposure and more. So long as the camera’s set to the appropriate mode, you can adjust the aperture, shutter speed, ISO sensitivity and white balance, along with being able to tap the live image on your handset to move the single AF area; note the exposure controls become greyed-out when you’re using the touch-focus, but pressing the touch-cancel button makes them live again. You can also use buttons on your phone to adjust the optical zoom.

The latest version of Smart Remote Control also lets you start and stop recording a movie from your handset, although you’ll first need to turn the camera’s mode dial to the movie position, and the video file also remains on the camera’s memory card. You can at least change the movie exposure mode (PASM) from your handset, and again set the aperture, shutter and ISO, or zoom the lens remotely if desired. Sadly the touch AF becomes disabled in the movie mode though, so there’s no chance to tap your handset’s screen to adjust it whether before or during a recording. This rules out the possibility of remotely pulling-focus – a shame, but then it’s churlish to complain when the earlier HX50V and HX60V had rudimentary smartphone remote control.

Speaking of which, at the time of writing, Sony offered only three apps for the HX90V, but I’d expect that number to increase pretty swiftly to more than a dozen as existing apps are updated to make them compatible.

Like its predecessors the HX90V is also equipped with a built-in GPS receiver. As well as tagging images with Lat and Long co-ordinates it also records altitude information and the direction of view. All of this can be used by software to map your photos to the location where they were shot.

The COOLPIX S9900’s GPS is similarly basic, though it does offer a mapping feature in the camera. Even that’s more than you can expect from Panasonic; earlier TZ series models included sophisticated mapping functions, but that, along with the built-in GPS, has been dropped from the TZ70 / ZS50 in favour of an option to sync a track log recorded on your smartphone.

The HX90V offers a number of composite modes that shoot a fast sequence of shots and composite them to provide a better result than would be possible with a single frame. Multi Frame Noise Reduction is available at sensitivity settings from 80 to 12800 ISO and there’s also Auto HDR which takes three images at increments of one to six EV, or the camera will determine the best option for you, and combines them in camera into a single JPEG file.

And it wouldn’t be a Sony compact without iSweep Panorama mode. Like previous Sony cameras you can choose between Standard and Wide for the size, and Right, Left, Up or Down for the direction. After that it’s just a case of holding the shutter release button down as you pan the camera in the selected direction.

The HX90V also includes Sony’s Picture Effect filters. There’s a good spread and I’ve included some examples below, but it’s disappointing to discover that you still can’t apply the miniature effect to movies.

Above left: Toy Warm. Above right: Posterization Color

Above left: Partial color Red. Above right: HDR Painting Mid

Above left: Rich-tone Mono. Above right: Watercolor

Sony's Cyber-shot HX90V is one of the smallest compacts with a 30x optical zoom. Successor to the popular HX60 and HX50, it shares a similar optical zoom range, but packed into a smaller body. The HX90V delivers an equivalent range of 24-720mm, taking you all the way from respectable wide angle to super-telephoto, although the earlier G-series optics have been upgraded to a new design by Zeiss. Like its big rival, Panasonic's Lumix TZ80 / ZS60, the HX90V features a built-in electronic viewfinder which is popped-out the top of the body for use like the recent RX100 models. Unlike the TZ80 / ZS60 though, the HX90V also sports an articulated (albeit not touch-sensitive) screen which can tilt up to face forward for selfies, along with built-in GPS hardware that's more convenient than syncing a log made with a smartphone. Ultimately, the Lumix takes the lead with 4k video, touch controls and support for RAW, but the HX90V has the GPS, tilting screen and slightly smaller body. Both are great high-end pocket super-zooms, but also consider Canon's SX720 HS which boasts a longer zoom than either at 40x.

Sony's Cyber-shot HX90V is one of the smallest compacts with a 30x optical zoom. Successor to the popular HX60 and HX50, it shares a similar optical zoom range, but packed into a smaller body. The HX90V delivers an equivalent range of 24-720mm, taking you all the way from respectable wide angle to super-telephoto, although the earlier G-series optics have been upgraded to a new design by Zeiss. Like its big rival, Panasonic's Lumix TZ80 / ZS60, the HX90V features a built-in electronic viewfinder which is popped-out the top of the body for use like the recent RX100 models. Unlike the TZ80 / ZS60 though, the HX90V also sports an articulated (albeit not touch-sensitive) screen which can tilt up to face forward for selfies, along with built-in GPS hardware that's more convenient than syncing a log made with a smartphone. Ultimately, the Lumix takes the lead with 4k video, touch controls and support for RAW, but the HX90V has the GPS, tilting screen and slightly smaller body. Both are great high-end pocket super-zooms, but also consider Canon's SX720 HS which boasts a longer zoom than either at 40x.