Voigtlander 65mm f2 APO-Lanthar Macro review-so-far

-

-

Written by Thomas

The Voigtländer 65mm f2 APO-Lanthar Macro from the Japanese manufacturer Cosina is a macro lens designed for mirrorless cameras and corrected for full-frame sensors. At 65mm its focal length is 30% longer than what is deemed “normal” but with the relatively bright f2.0 focal ratio the lens should still be a good choice for street photography and general-purpose use. On a DX/APS-C sensor camera the lens has an angle-of-view equivalent to a 98mm lens which makes is a good choice for portraiture. It’s manual focus only and allows for a maximum magnification of 1:2 at its minimum object distance of 31cm (1ft.). Aperture operation is also manually but the lens has contacts to communicate EXIF data and works well with MF support from the camera. The Voigtländer 65mm f2 APO-Lanthar Macro is made in Japan and should become available in November 2022 for Nikon’s Z-mount. It is already available for Sony E-mount for 975 EUR / 949 USD / 749 GBP. Expect the Z-mount version to be slightly more expensive. Both versions look a bit different on the outside, but the optical formula and performance should be the same.

I hope to test the Voigtländer 65mm f2 APO-Lanthar Macro as soon as the Z-mount version becomes available to judge optical performance against the Nikon Z MC 50mm f2.8. My full review should then answer the question whether the qualities of the Voigtländer outweigh the hassles of manual focus when selecting a short(ish) macro lens for your Nikon mirrorless camera. And if you’re interested in Cosina’s other full-frame prime lenses for Nikon Z-mount (and Sony E-mount) have a look at my Voigtlander 35mm f2 APO-Lanthar review and my Voigtlander 50mm f2 APO-Lanthar review.

Facts and features

Let’s have a look at the technical data of the Voigtländer 65mm f2 APO-Lanthar Macro in Z-mount version first. I’ve rated the features with a [+] (or [++]), when it’s better than average or even state of the art, a [0] if it’s standard or just average, and [-] if there’s a disadvantage. For comparison I use the Nikon Z MC 50mm f2.8 (“Z-Nikkor” for short) and Sony FE 50mm f2.8 Macro (“Sony FE”). For good measure I’ve also added the Sigma 65mm f2 DG DN (“Sigma DN”) which only offers a maximum magnification of 1:5.6 but matches the Voigtlander in focal length and focal ratio and is available for Sony E-mount.

Size (diameter x length): 78 x 89mm (3.1 x 3.5in.) with the E-mount version being 10mm longer. The lens hood adds around 18mm and is 69mm in diameter and the lens extends 33mm when focused to minimum object distance. The Z-Nikkor is 75 x 66mm + 6mm lens hood + 26mm extension, the Sony FE is 71 x 71mm + 27mm extension (no lens hood), the Sigma DN is 72 x 77mm + 38mm lens hood and is the only lens which does not extend when focusing closer. [0]

Weight: At 618g (21.8 oz.) plus an estimated 25g for the metal lens hood the Voigtländer is by far the heaviest of the group due to its bright focal ratio and metal body. The Z-Nikkor is 260g + 5g lens hood, the Sony FE is 236g. Even the Sigma DN is only 407g + 55g lens hood although it also has a metal body and sports a focal ratio of f2. [-]

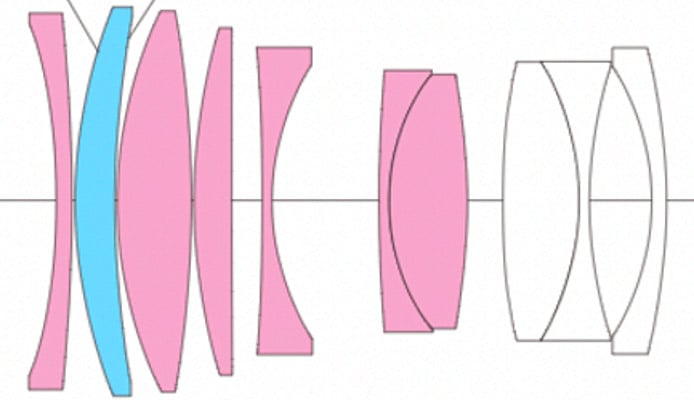

Optics: 10 elements (including 6 special dispersion and 1 aspherical) in 8 groups. The Z-Nikkor is a 10/7 design, the Sony FE is 8/7, the Sigma DN is 12/9. [+]

Minimum object distance is 0.31m (1.0ft.) with a magnification of 1:2, which is only half of what the Z-Nikkor and Sony FE achieves which both reach 1:1. The Sigma DN achieves only 1:5.7. Working distance of the Voigtländer from the front of the lens (without lens hood) to the object is 17cm at a magnification of 1:2. [0]

Use with teleconverters: None of the lenses in this comparison can be used with teleconverters. [0]

Filter-thread: 67mm on the Voigtländer, the Z-Nikkor has 46mm, the Sony FE 55mm, the Sigma DN 62mm. [+]

Image stabilization: The lenses in this comparison don’t have optical stabilization. You only get the built-in sensor-shift stabilization which most modern mirrorless camera bodies provide. [0]

Auto focus: No, the Voigtländer is manual focus only. The focus ring has a large throw and the usual linear gearing of manual focus lenses with distance markings in m and ft plus a dof indicator. The Z-Nikkor, Sony FE, and Sigma DN have the typical non-linear gearing of focus-by-wire. Both the Z-Nikkor and Sony FE have a scale with focus distance and magnification on their extending inner tubes. It becomes visible as soon as magnification is larger than 1:2 resp. 1:4. [-]

Although the Voigtländer has only manual focus and manual aperture operation the lens has contacts to communicate EXIF data like focal length and aperture to the camera. The E-mount version also communicates the focus distance which allows Sony Alpha cameras to support 5-axis image stabilization, while on a stabilized Nikon Z camera only three axis are supported. Some of the MF support is also activated like the viewfinder magnification on Sony cameras or changing the focus point frame color on a Nikon Z body. [0]

Covers full frame/FX or smaller. Same with the alternatives. [+]

Price: 975 EUR (incl. 19% VAT) / 949 USD / 749 GBP for the E-mount version. The Z-Nikkor currently goes for about 699 EUR / 647 USD / 616 GBP (with rebates), the Sony FE is at 465 EUR / 548 USD / 449 GBP, the Sigma DN is at 630 EUR / 649 USD / 632 GBP. [-]

The Voigtländer comes without a pouch, but the metal lens hood is included. It is of the screw-on type and is not reversible for transport. Both the Z-Nikkor and Sigma DN come with a soft pouch and reversible lens hood with bayonet coupling. The Sony FE comes without pouch or lens hood. [0]

Aperture ring: The Voigtländer has a dedicated aperture ring with 1/3 click-stops from f2.0 to f22 similar to the Sigma DN. On the Z-mount version the click-stops cannot be switched off. The Z-Nikkor has a multi-function control ring which can be assigned by the camera to operate the aperture, exposure compensation, ISO sensitivity, focus – or simply switched off. The Sony FE has no aperture ring. [+]

Sealing: No, the Voigtländer doesn’t even have a rubber grommet at the lens-mount which all other lenses in this comparison employ. The Z-Nikkor and Sony FE have further special weather-sealing throughout their construction. [-]

At a score of 4[-]/6[0]/3[+] the Voigtländer 65mm f2 APO-Lanthar Macro doesn’t look like an attractive lens: It is heavy, expensive, not weather sealed, only goes down to a magnification of 1:2 and is manual focus only. The absence of autofocus does not seem too big of an issue especially in macro photography. But keep in mind that without AF you cannot use the focus bracketing feature of Nikon Z bodies which takes the hassle out of focus stacking. Instead, you have to rely on a focus rail for stacking. On the plus side is its relatively bright focal ratio of f2 and full metal construction which leaves a very sturdy and well-engineered impression. So, with a price that’s higher than the alternatives with autofocus it comes down to whether the optical qualities of the Voigtländer are superior to what the other lenses offer.

Sharpness and contrast

Let’s have a look at the theoretical performance of the Voigtländer 65mm f2 APO-Lanthar Macro and compare it to the performance of the Nikon Z MC 50mm f2.8, Sony FE 50mm f2.8 Macro, and two other lenses which do not offer macro capabilities but might otherwise be considered viable alternatives:

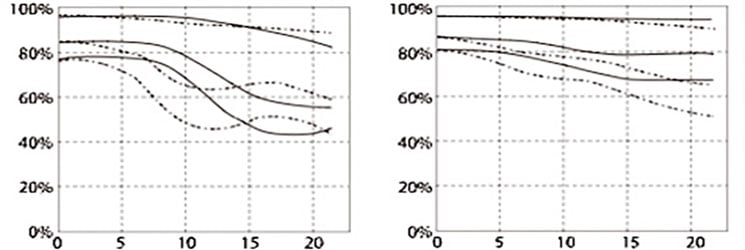

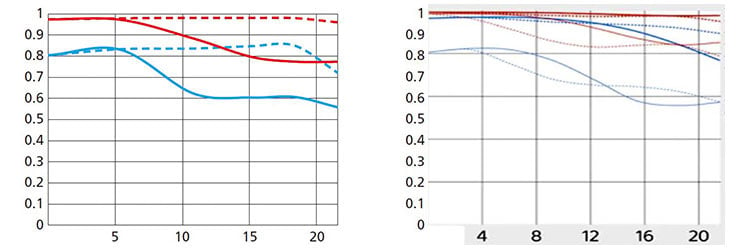

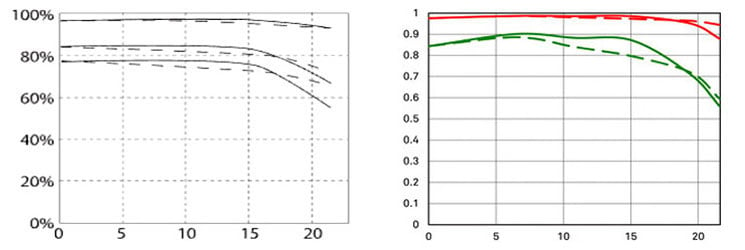

Above: Voigtländer 65mm f2 APO-Lanthar Macro at f2.0 (left) and f4.0 (right)

Above: Nikon Z MC 50mm f2.8 (at f2.8), Sony FE 50mm f2.8 Macro (blue= f2.8)

Above: Voigtländer 50mm f2 APO-Lanthar, Sigma 65mm f2 DG DN (both at f2.0)

The MTF charts of the Voigtländer lenses show the computed contrast-curves without influence of diffraction at 10 line-pairs/mm, 30 lp/mm, and 40 lp/mm (from top to bottom). The charts from Nikon, Sony and Sigma show 10/30 lp/mm. Higher values are better (more contrast) and the closer the dotted and solid lines are together the less contrast dependents on the orientation of the test-pattern (less astigmatism). The x-axis displays the distance from the optical axis (=center of the sensor) in mm.

One observation becomes immediately apparent: All macro lenses in this comparison show a clear dip in sharpness (30 lp/mm) before reaching the DX/APS-C corner at 14mm. This makes the Voigtländer 50mm f2 APO-Lanthar and Sigma 65mm f2 DG DN look better (on paper at least) at f2.0 than the macro lenses – even those with a focal ratio of f2.8. Keep in mind though that these MTF charts show the performance at (or near) infinity and the closer you focus the larger the circle of peak performance should become. Plus, you normally have to stop down for macro shoots to increase depth of field which boosts resolution further – before diffraction sets in. Stopping the 65mm f2 APO-Lanthar Macro down to f4.0 shows pretty even performance across the full frame.

To see whether these differences on paper have any relevance in real life check back for my full review of the Voigtländer 65mm f2 APO-Lanthar Macro once the lens becomes available for Z-mount.

Check prices on the Voigtlander 65mm f2 APO-Lanthar Macro at B&H, Adorama, WEX UK or Calumet.de. Alternatively get yourself a copy of my In Camera book, an official Cameralabs T-shirt or mug, or treat me to a coffee! Thanks!